Foreign Media: 2016 over 75 billion dollars of overseas investment in China was cancelled

"The observer network/Chang Heng" of China's foreign investment becoming rational, on the other hand, the United States and Europe seems there is an increasing trend of China outbound investment block. According to Britain's financial times reported on February 6, 2016 Chinese direct investment in the United States and Europe hit a record US $94.2 billion, but at the same time 30 deals worth about $75 billion was cancelled.

Observers website rhodium consulting (Rhodium) latest report--2016 report found that Chinese investment in Europe to the United States, Rong Ding 2016 Advisory statistics China's direct investment in the US and Europe for us $83.8 billion (slightly different from data of the financial times). The United States direct investment of 46 billion dollars, 35 billion euros in Europe (about 37.8 billion US dollars).

Rong Ding consulting is a multinational consulting firm headquartered in New York, long-term study of China's overseas investment and the Chinese economy.

Face of the wave of mergers and acquisitions of Chinese capital in the US and Europe, "sit", and number of transactions to be stopped in the name of national security, the financial times cited two well-known examples:

A Chinese Consortium trying to have $3 billion acquisition of Dutch group Philips (Philips) lighting equipment Division in the United States, but rejected by the Committee on foreign investment in the US (the Committee on Foreign Investment in the United States) block.

20 European deals worth 16.3 billion dollars was canceled, including the proposed sale of 670 million euros Germany chip equipment maker top ACE (Aixtron).

2016 main Chinese investment in Europe for advanced technologies

Rong Ding consulting survey, stymied in Europe has been more and more, succeed in buying often twists, such as the Chinese corporate takeover of a German robot manufacturer KUKA has been repeatedly rejected. Report finds that Chinese acquisition of Europe began to the core technology is the main reason, especially in 2016, China's acquisition of advanced technology is often.

The other hand, Rong Ding believes that Europe's major industrial countries are wary of China's capital, is also very important for political reasons.

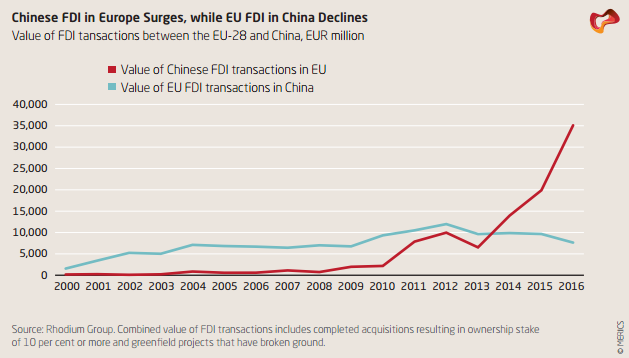

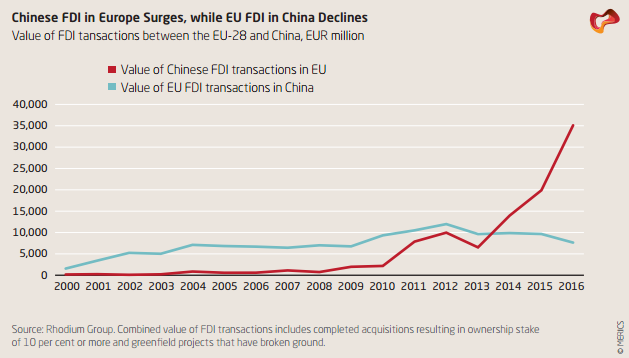

Part of EU agencies think China is entering the lot can be used in dual-use sensitive businesses, could pose a threat to European security. And the time when the EU is trying to invest in China, and China's large area but does not allow foreign investment in sensitive industries, such as nuclear, semiconductor, and other departments. So when Chinese investment in Europe 35 billion euros (37.8 billion dollars) when European investment in China is in the downhill, 16 only about 8 billion euros (about 8.64 billion u.s. dollars). EU is very dissatisfied with this.

Both sides on each other's investment trend, Red China, blue Europe in 2016, European investment of 35 billion euros, about $37.8 billion (source: Rong Ding Consulting)

Both sides on each other's investment trend, Red China, blue Europe in 2016, European investment of 35 billion euros, about $37.8 billion (source: Rong Ding Consulting)2016-European investment in China also has a new feature, after a few years ago after the massive investment to South Eastern Europe and other places, China's capital has returned to the United Kingdom, and Germany, and France all three core countries.

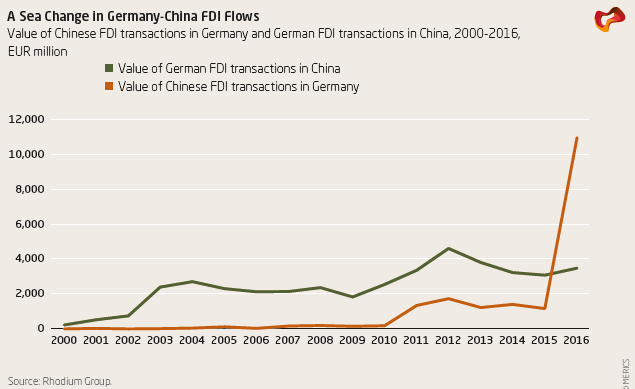

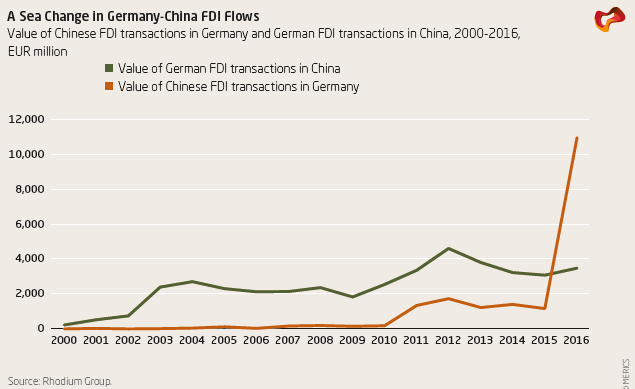

Germany, in particular, China's investment in Germany is extremely alarming and growing fears in Germany.

NET previously reported, according to the observer, German television station N-TV reported that China's new strategy "made in China" 2025 "will threaten Western industrial State's status. Bailinmokatuo China Research Center on Wednesday unveiled the "made in China" 2025 "report. Reports said China's goal is to upgrade their production facilities, and strive to become "high-tech power". Not technology, China will mainly to buy Western companies to gain. China's goal is to eventually replace Western technology with Chinese technology.

China's investment in European countries (Rong Ding Consulting)

China's investment in European countries (Rong Ding Consulting) To Chinese investment in Germany (source: Rong Ding Consulting)

To Chinese investment in Germany (source: Rong Ding Consulting) Chinese investment one-third real estate

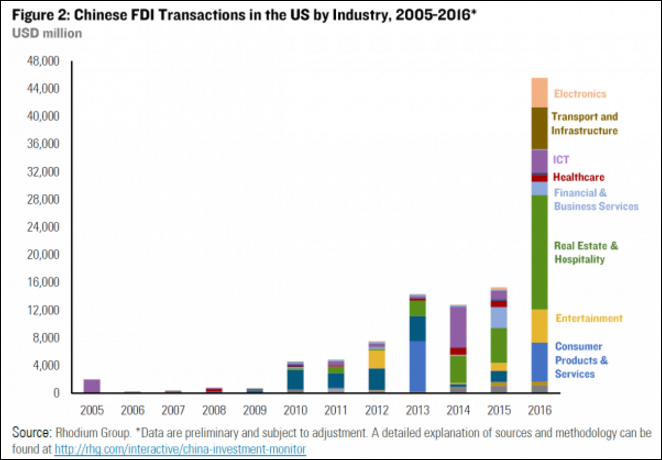

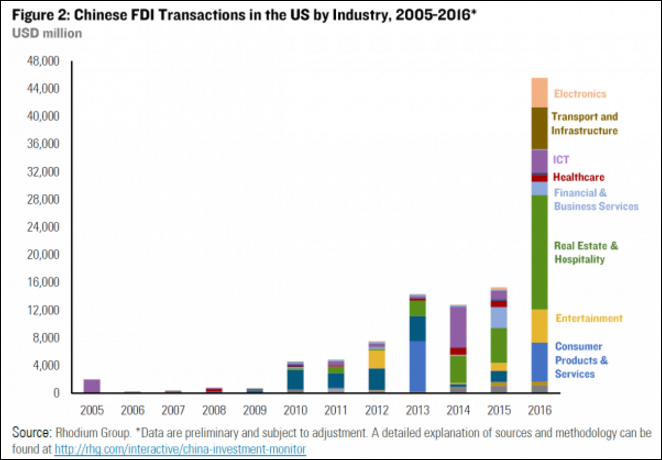

Compared to Chinese investment in the European core industries, China's investments in the United States are different.

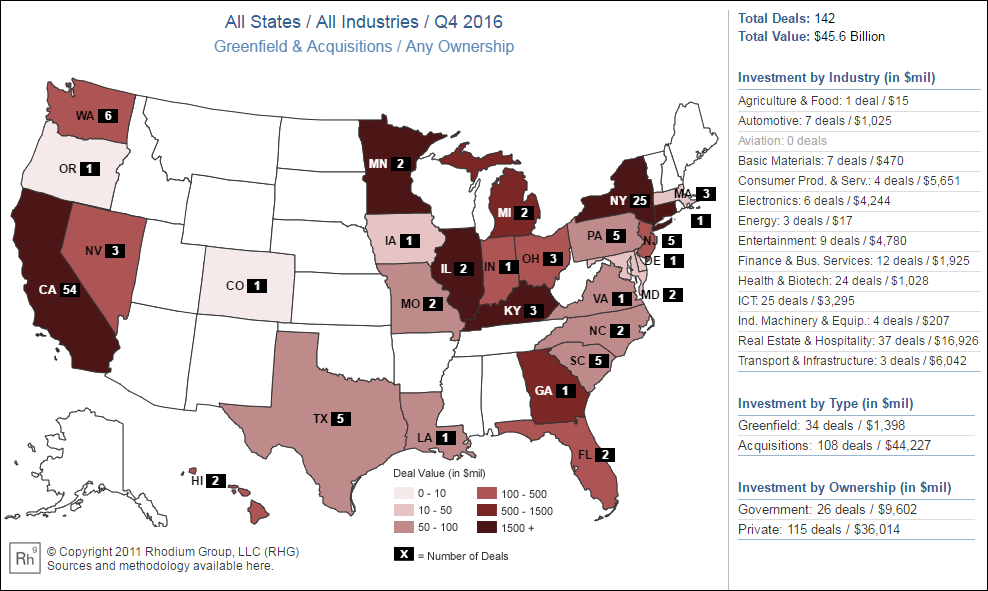

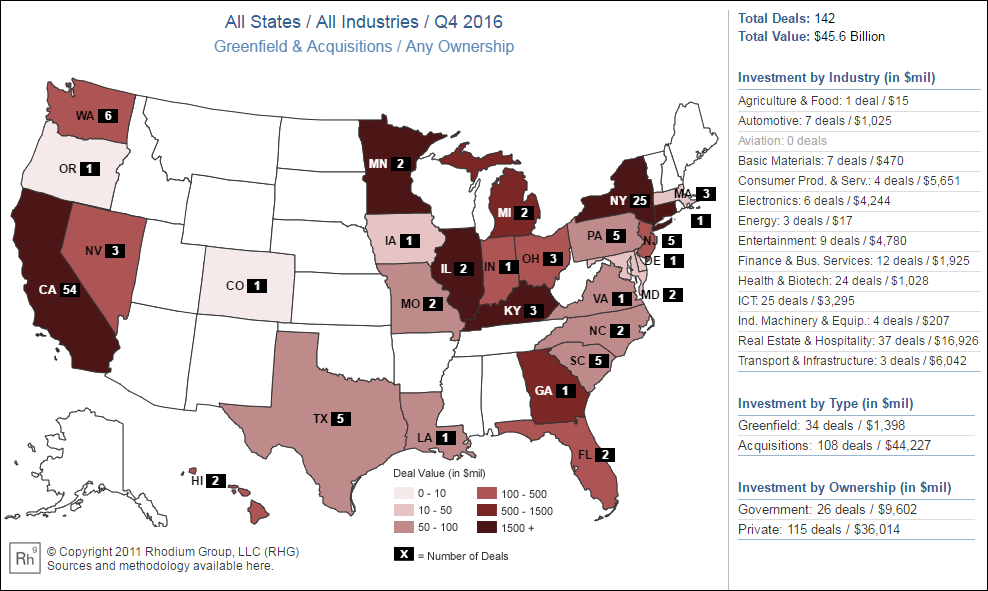

As shown in the following figure, in 2016, investment in China amounted to us $46 billion, "big head" is still the real estate and hotel industries (Real Estate & hospitality) accounted for about $17 billion. Second was extremely fast-growing transportation and infrastructure sectors (Transport & Infrastructure) about $5.65 billion. And we care about electronics (Electronics), information technology (ICT) and machinery and equipment (Ind. Machinery & Equip) adds up to about $7.7 billion.

2016 region and areas for Chinese investment in the United States, by 2016 the fourth quarter, Chinese investment amounted to us $46 billion (source: Rong Ding Consulting)

2016 region and areas for Chinese investment in the United States, by 2016 the fourth quarter, Chinese investment amounted to us $46 billion (source: Rong Ding Consulting) Trend of Chinese investment in the United States (2016-China region and areas for investment in the United States (source: Rong Ding Consulting)

Trend of Chinese investment in the United States (2016-China region and areas for investment in the United States (source: Rong Ding Consulting)But the vigilance of Americans no less European. The United States on national security grounds to stop China's acquisition of Germany's famous top ACE chip enterprises. In addition, according to the first reports of latest cases come from China zhongwang zhongwang affiliates United States (ZHONGWANGUSALLC) and the United States Aleris Aluminum Ltd (AlerisCorporation) takeover, recently 12 United States Senator paper referred to the United States Treasury Department, led to the takeover might happen in the future involving the $2.33 billion variables.

Regulators hope that overseas investment more rational

The other hand, the expansion of China's overseas investment also need supervision, financial times believes that overseas transactions worth more than $75 billion in China last year was canceled, in part because regulation and foreign exchange constraints resulting in 30 European and American business deals fall through. By contrast was withdrawn in 2015 traded value of only about $10 billion.

Late last year, regulators stepped up non-rational supervision of overseas investments, focus on capital outflows by illegal means.

Xinhua News Agency, on November 18, 2016, the national development and Reform Commission, the Ministry of Commerce of China, the people's Bank, the foreign exchange Bureau of four departments, has heavily regulated "buy buy buy". In press conference Shang, four sector head said, "China foreign investment of approach policy and management principles is clear of, that insisted implementation new a round high opening, insisted implementation" out of to "strategy, insisted Enterprise subject, and market principles, and international practice, and Government Guide, insisted implemented to record business mainly of foreign investment management way, put advance foreign investment convenience of and prevention foreign investment risk combined up, specification market order, by about provides on some enterprise foreign investment project for verified, Promoting the sustained and healthy development of China's foreign investment and achieve mutual benefit and win-win and common development. ”

(Editors: Liu Longlong UN827)

2017-02-06 16:46:25

Observer network

外媒:2016年中国超750亿美元海外投资被取消

【文 观察者网/张珩】中国对外投资行为日趋理性,另一方面,美国和欧州方面对中国的对外投资阻挠似乎有加大趋势。据英国金融时报2月6日报道,2016年中国对美欧的直接投资达到了创纪录的942亿美元,但同时价值约750亿美元的30笔交易被取消。

据观察者网查询荣鼎咨询(Rhodium)的最新报告——2016中国对欧对美投资报告发现,荣鼎咨询统计的2016年中国完成的对美欧直接投资为838亿美元(与金融时报的数据略有不同)。其中对美国的直接投资为460亿美元,欧洲为350亿欧元(约378亿美元)。

荣鼎咨询是总部设在纽约的一家跨国咨询公司,长期研究中国海外投资和中国经济。

面对中国资本并购潮,美欧有些“坐不住”,多项交易被以国家安全名义喊停,《金融时报》列举了两个众所周知的例子:

一家中资财团试图以30亿美元收购荷兰集团飞利浦(Philips)位于美国的照明设备分部,但遭到了美国外国投资委员会(Committee on Foreign Investment in the United States)的阻挠。

价值163亿美元的20笔欧洲交易被取消,包括拟议以6.7亿欧元出售的德国芯片设备制造商爱思强(Aixtron)。

2016年中国对欧投资主要针对先进技术

荣鼎咨询的调查报告显示,中国在欧洲遭到了越来越多的阻挠,成功的收购往往一波三折,比如中国企业对德国机器人制造商库卡的收购先后被多次否决。报告认为,中国对欧的收购开始走向核心科技是主要的原因,尤其是2016年中国的收购往往针对的是先进的技术。

另一方面,荣鼎咨询认为现在欧洲的各个主要工业国家都开始警惕中国的资本进入,政治原因也非常重要。

一部分欧盟机构认为中国正在进入很多可以用于军民两用的敏感企业,有可能会威胁欧洲的安全。而当欧盟试图向中国投资的时候,中国大量的敏感产业领域却不允许外资进入,如核电、半导体等部门。所以当中国对欧投资了350亿欧元(约378亿美元)的时候,欧洲对中国的投资却是在下坡路,16年仅仅只有80亿欧元(约86.4亿美元)。欧盟对此非常不满。

中欧双方对彼此的投资走向,红色是中国、蓝色是欧洲,2016年中国对欧投资为350亿欧元,约378亿美元(图片来源:荣鼎咨询)

中欧双方对彼此的投资走向,红色是中国、蓝色是欧洲,2016年中国对欧投资为350亿欧元,约378亿美元(图片来源:荣鼎咨询) 中国2016年对欧的投资还有一个新的特点,在经过了前些年对南欧东欧等地的大规模投资之后,中国的资本又回到了英国、德国、法国这三个核心国家。

尤其是德国,中国对德投资的增长速度极为惊人,而德国的担忧也与日俱增。

据观察者网先前报道,德国N-TV电视台报道称,中国的新战略“中国制造2025”将威胁到西方工业国家的地位。柏林墨卡托中国研究中心周三公布了对“中国制造2025”的研究报告。报告表示,中国的目标是先更新生产设备,然后争取成为“高科技大国”。自己没有的技术,中方将主要通过购买西方企业来获取。中方的目标是最终以中国技术取代西方技术。

中国对欧洲国家的投资状况(荣鼎咨询)

中国对欧洲国家的投资状况(荣鼎咨询) 中国对德投资走向(图片来源:荣鼎咨询)

中国对德投资走向(图片来源:荣鼎咨询) 中国投资美国三分之一是房地产

相比中国在欧洲投资核心产业,中国在美国的投资却有所不同。

如下图所示,中国在2016年对美投资总额为460亿美元,“占大头”的依然是房地产和酒店行业(Real estate & hospitality)占约170亿美元。其次是增长极快的交通和基建领域(Transport & Infrastructure)约56.5亿美元。而大家所关心的电子(Electronics)、信息科技(ICT)和机械设备(Ind. Machinery & Equip)加起来约77亿美元。

2016年中国在美国投资的地域和领域,截止到2016年第四季度,中国对美投资的总额为460亿美元(图片来源:荣鼎咨询)

2016年中国在美国投资的地域和领域,截止到2016年第四季度,中国对美投资的总额为460亿美元(图片来源:荣鼎咨询) 中国在美投资走势(2016年中国在美国投资的地域和领域(图片来源:荣鼎咨询)

中国在美投资走势(2016年中国在美国投资的地域和领域(图片来源:荣鼎咨询) 但是美国人的警惕性丝毫不亚于欧洲人。比如美国以国家安全为由,制止中国收购德国著名芯片企业爱思强 。此外据第一财经报道,最新的案例则来自于中国忠旺关联公司忠旺美国(ZHONGWANGUSALLC)和美国爱励铝业有限公司(AlerisCorporation)的并购案,近期被12位美国参议员一纸告到了美国财政部,导致这场涉及23.3亿美元的收购未来可能发生变数。

监管层期望海外投资更加理性

另外一方面,中国海外投资的扩张也需要监管,金融时报认为,去年中国有价值逾750亿美元的海外交易被取消,一部分原因是监管加强和外汇限制导致30笔对欧洲和美国企业的收购交易落空。相比之下2015年被取消交易价值只有约100亿美元。

去年下半年,监管层加大了对非理性海外投资的监管力度,重点打击通过非法手段的资本外流。

新华社2016年11月18日,国家发展改革委、中国商务部、人民银行、外汇局四部门共同严厉监管“买买买”。在新闻发布会上,四部门负责人表示,“中国对外投资的方针政策和管理原则是明确的,即坚持实施新一轮高水平对外开放,坚持实施“走出去”战略,坚持企业主体、市场原则、国际惯例、政府引导,坚持实行以备案制为主的对外投资管理方式,把推进对外投资便利化和防范对外投资风险结合起来,规范市场秩序,按有关规定对一些企业对外投资项目进行核实,促进中国对外投资持续健康发展,实现互利共赢、共同发展。”

(责任编辑:柳龙龙 UN827)

2017-02-06 16:46:25

观察者网